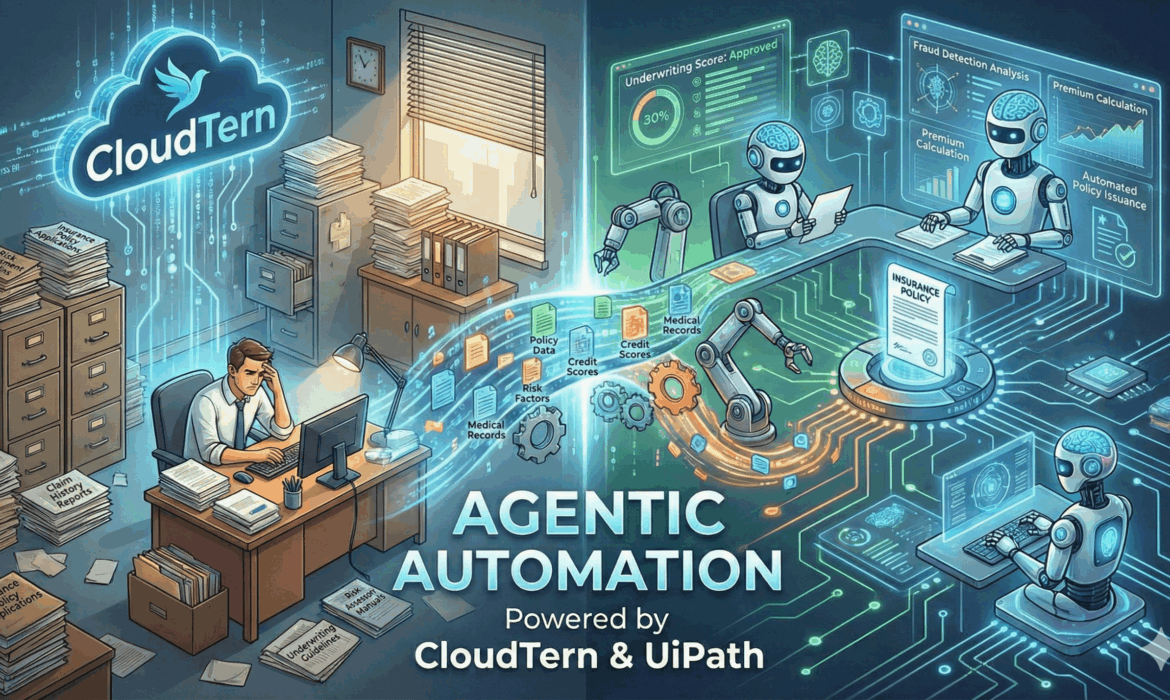

The insurance industry is undergoing its most significant transformation in decades. Rising customer expectations, regulatory complexity, and massive volumes of unstructured data have pushed underwriting teams to their limits. Traditional RPA and rule-based automation helped but today’s underwriting landscape demands something more adaptive, more intelligent, and more autonomous.

That next step is Agentic Automation.

With CloudTern becoming a UiPath Agentic Automation Fast Track Partner, we are uniquely positioned to help insurers modernize underwriting operations through AI-powered agents that understand, reason, and act just like human underwriters.

Unlike traditional automation, these AI agents are:

- Goal-oriented (e.g., “complete this underwriting file end-to-end”)

- Context-aware (understand risk factors, exclusions, documents, and applications)

- Adaptive (handle exceptions, learn from underwriter feedback)

- Cross-functional (work across email, portals, CRMs, policy admin systems)

This brings insurers closer to the vision of the autonomous underwriting desk, where humans focus on judgment, and AI handles the heavy lifting.

Why Underwriting Needs Agentic Automation Now

Insurance underwriting is slowed down by several systemic challenges:

1. Unstructured Document Chaos

90% of underwriting time is spent reading:

- ACORD forms

- Financial statements

- Medical records

- Risk reports

- Emails and Attachments

- Compliance documents

Agentic automation can read, extract, summarize, and classify all of this instantly.

2. High Cycle Times

Commercial underwriting cycles often take days or weeks due to:

- Manual data entry

- Multi-system workflows

- Constant back-and-forth with brokers

- Repetitive reviews

AI agents cut cycle time to minutes.

3. Talent Shortage

Skilled underwriters are expensive, hard to hire, and overloaded.

Agentic automation gives every underwriter a personal AI assistant.

CloudTern + UiPath: Transforming Underwriting with Agentic Automation

CloudTern’s partnership with UiPath is a major milestone for insurance customers looking to modernize underwriting operations.

As a UiPath Agentic Automation Fast Track Partner, CloudTern brings insurers the combined power of:

- UiPath’s enterprise-grade automation platform

- CloudTern’s deep insurance domain expertise

- AI-driven underwriting accelerators

- Modern agentic workflow designs

Here’s how this partnership elevates underwriting automation.

1. End-to-End AI Agents for Underwriting

CloudTern can now deploy AI agents built on UiPath’s Agentic Automation Framework that handle:

- Submission Intake

- Document Understanding

- Risk Assessment Assistance

- Quote Preparation

- Communication Automation

This builds a “digital underwriting desk” that works 24/7.

2. Combining UiPath RPA + CloudTern AI = True Agentic Underwriting

The combination allows insurers to automate across the entire underwriting lifecycle:

UiPath Provides

- Enterprise RPA

- Secure workflow orchestration

- Governance & compliance

- GenAI connectors

- Document Understanding

CloudTern Provides

- Underwriting domain expertise

- AI reasoning models

- Workflow automation architecture

- Custom unstructured data solutions

- Integration across PAS, CRM, ERP, email, portals

The result is underwriting automation that is intelligent, scalable, and deeply aligned with industry regulations.

3. Improved Accuracy, Speed & Customer Experience

Agentic underwriting brings measurable benefits:

- 60–80% reduction in manual effort

- 50–70% faster quote turnaround

- Significant reduction in underwriting leakage

- Higher submission-to-bind ratios

- Better risk visibility and auditability

- Stronger broker relationships through faster responses

Underwriters spend more time on judgment not paperwork.

The Future of Underwriting Is Agentic And It Starts Now

Agentic automation is not replacing underwriters—it’s empowering them.

Insurers adopting this technology today will:

- Reduce underwriting costs

- Improve profitability

- Increase bind ratios

- Accelerate growth

- Deliver superior broker and customer experiences

With CloudTern’s expertise and UiPath’s agentic automation platform, insurers can transform underwriting operations from manual and reactive to intelligent and autonomous.